How to charge tax: VAT, Sales tax & GST (with Stripe Tax)

Automatically calculate and collect taxes on your sales. We integrate with Stripe Tax to help you calculate, collect and remit VAT, Sales tax and/or GST on your sales.

Stripe Tax

With Stripe Tax you can automatically calculate, collect and remit VAT, Sales tax and/or GST on your sales.

Stripe Tax provides you with helpful, detailed reports that you can use to report and remit your taxes globally.

Stripe Tax also monitors when you may have exceeded a tax threshold in a country you're not currently registered to pay tax.

How to set up Stripe Tax

- Enable Stripe tax collection on your checkout pages and event pages by clicking on Store settings and then Stripe tax

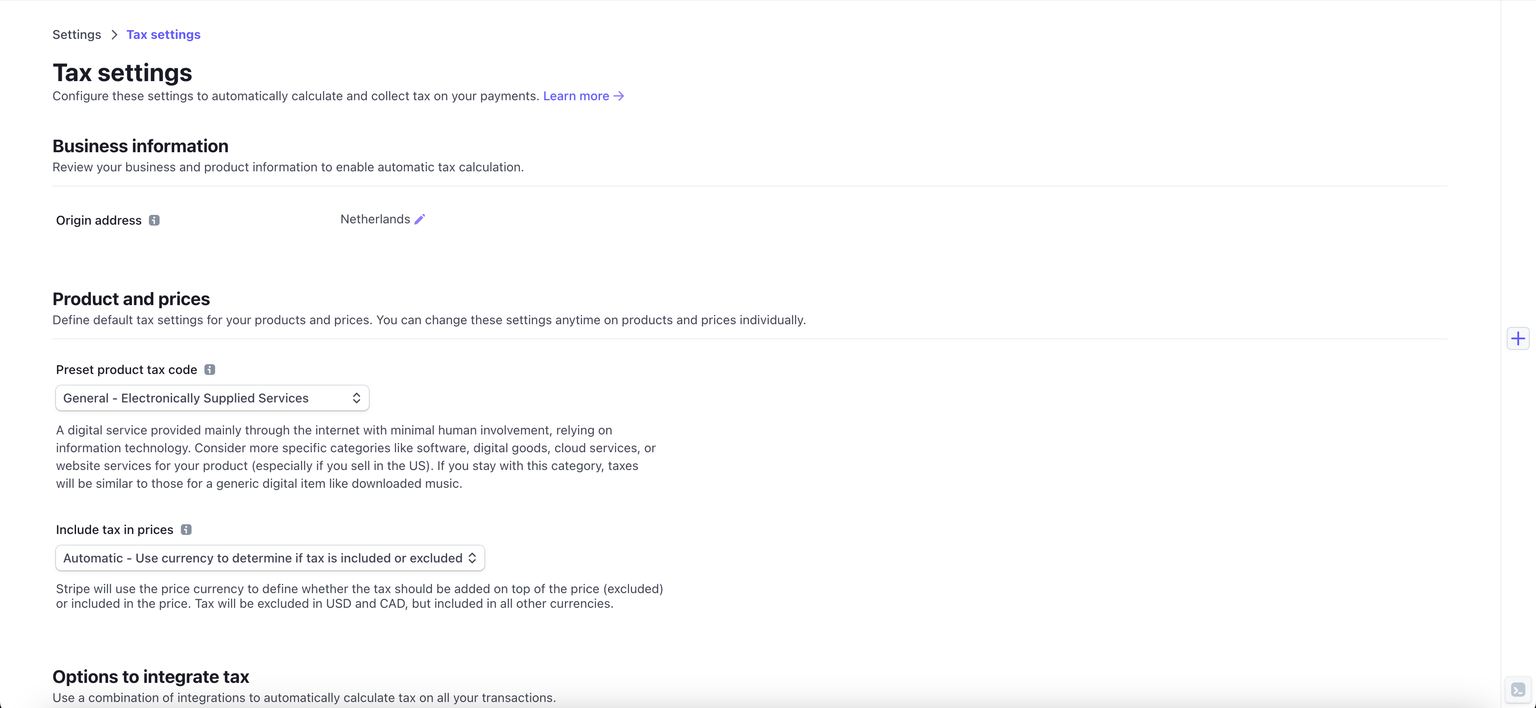

- Enable Stripe Tax in the Stripe Dashboard

- Set up your tax settings in the Stripe Dashboard. You can set your default tax category and if tax is included or excluded in your product prices.

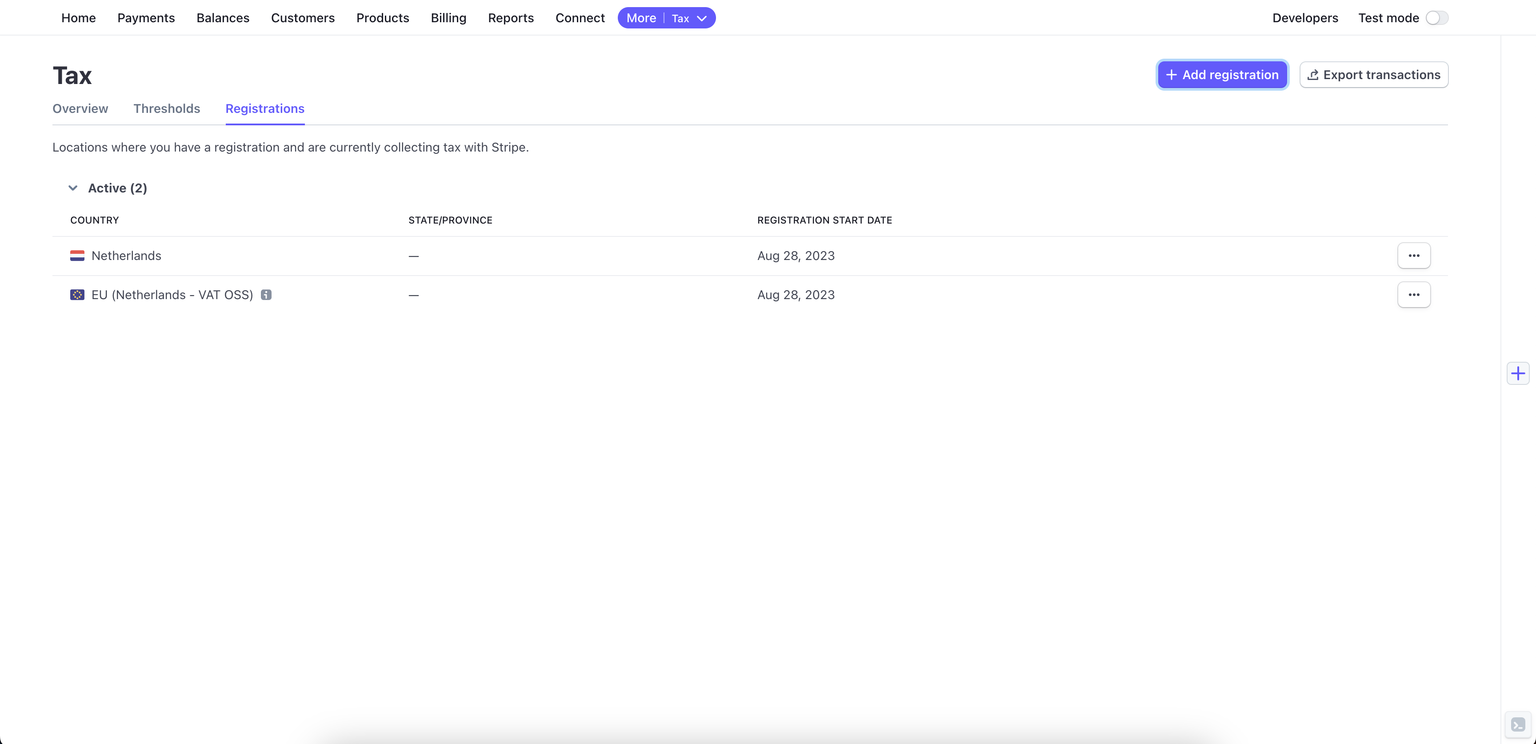

- Add your tax registrations in the Stripe Dashboard. Tax registrations are locations where you’re registered to collect and remit taxes.

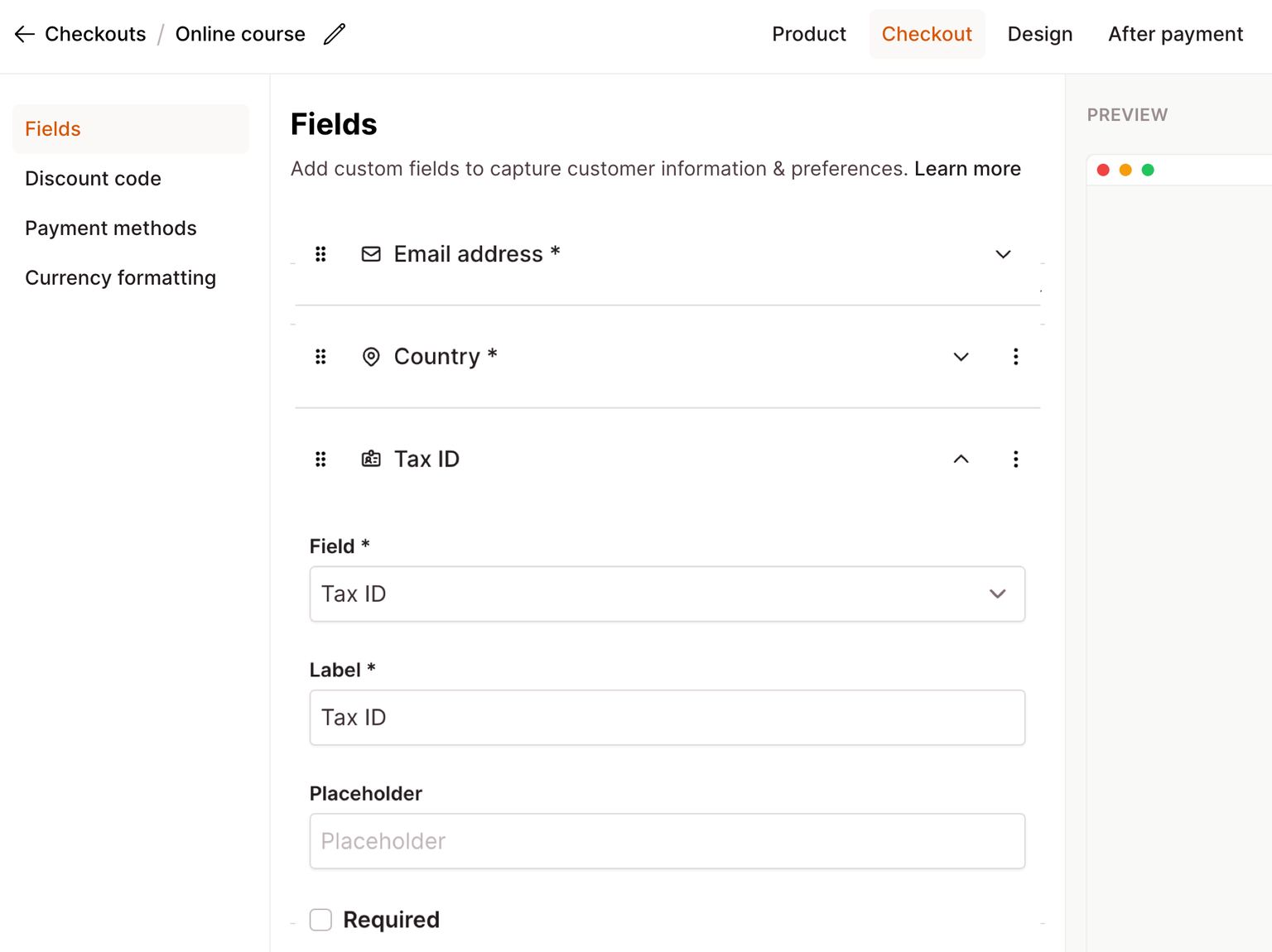

- You must add the following fields (and corresponding data types) to your checkout pages and events pages to calculate and collect taxes:

- United States: Country, address line one, postal code

- Canada: Country, postal code

- EU: Country, postal code

- United Kingdom: Country

- All other countries: Country

Note: we recommend collecting a full address from your customers for the most accurate tax calculation result.

- If you’re selling to businesses, you’ll likely want to collect their Tax ID (e.g. VAT number). To do so, you can add a Tax ID field to your checkout. ^

- The Tax ID will be validated based on the format, but it’s up to you to validate if the Tax ID registration matches the customer information.

The tax will be (re)calculated as your customer moves through your checkout form, based on the checkout price, customer location and customer Tax ID.

Stripe will charge the taxable amount on all payments, display the tax on your customer invoices and provide you with exports of your transactions.

Per-page settings

You can enable or disable Stripe Tax for individual pages in the page's checkout settings. Edit your page, click on the "Checkout" tab, and look for "Stripe Tax".

You can set the tax behavior (inclusive or exclusive) for individual pages in the page's checkout settings.

Subscription pages always use the tax behavior set in your Stripe Tax settings.

Exporting tax transactions & reports

Stripe Tax provides reports of completed transactions, including the tax amount collected and the tax rate applied.

To access these reports, visit Registrations in the Stripe Dashboard.

For more information about exporting your tax transactions, please refer to Stripe's documentation on Tax reporting and filing

Manage invoices sent to customers

Our Stripe integration also allows you to manage the invoices and credit notes sent to your customers. Learn more about Stripes invoices here

Stripe Tax pricing

Stripe Tax is priced separately by Stripe.

- Subscriptions: 0.5% per transaction, where you’re registered to collect taxes

- One-time payments: 50¢ per transaction, where you’re registered to collect taxes