Payment and installment plans continue to gain popularity, and for good reason.

They allow customers to access a product or service without committing to the full cost upfront. Instead, they can pay for the product in installments over a set period of time—often without interest or with minimal fees for the buyer.

This article reveals how to easily sell Stripe payment plans and the pros and cons of offering these plans to your customers.

We also examine how Checkout Page allows you to set up payment plan options for your customers with just a few clicks.

What is a payment plan?

A payment or installment plan is a solution that enables buyers to divide the total cost of a purchase into smaller, more manageable amounts and spread those out over a set period of time—commonly monthly—until the full price of the purchase is covered.

Buy now, pay later plans

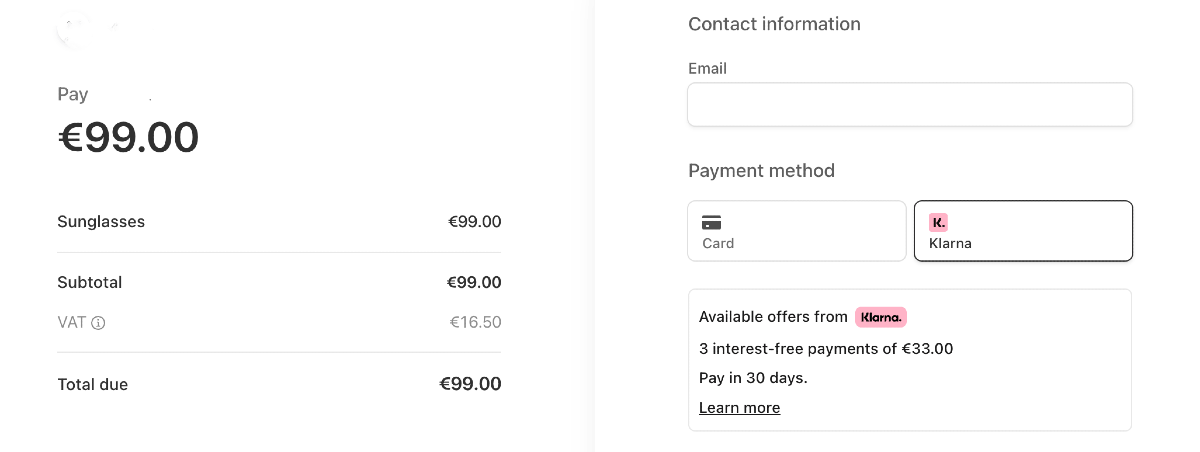

‘Buy now, pay later’ (BNPL) payment plans take the form of a loan or credit option, where the buyer borrows from a loan provider — like Klarna, Afterpay/Clearpay, Affirm or Zip — via the payment processing platform.

The seller is paid in full upfront, and the buyer pays off the loan to the loan provider over time.

Buy now, pay later plans cost sellers a percentage of the sale plus a flat fee.

For example, Klarna applies a $5.99% + 30¢ fee to transactions within the US and an extra 1.5% for international transactions. If the product you sell gets lost and is disputed with the buyer, a further $15 fee is applied.

It's important to review each provider's associated fees before making an informed decision about offering a buy now, pay later service through Stripe.

Installment plans

Another type of installment plan is a phased payment, where the total cost is split into several parts to be paid at an agreed-upon frequency—for example, 25% of the total each month for four months. In the latter case, the seller is not paid in full until all the installments are paid.

This kind of plan is popular for sellers offering a product that is delivered over time, such as an online course that takes place over 6 months.

What is Stripe?

Stripe is one of the leading payment processing platforms for businesses of all sizes, from startups and individual creators to established brands.

Stripe has a reputation as a reliable, secure, and flexible payment processor — thanks to its ease of use, variety of payment processing solutions, and adherence to high-security standards.

Stripe customers can accept a wide range of payment methods in numerous currencies and offer payment options such as Stripe installments — making it a perfect fit for online and digital creators wanting to lower the barriers to purchase and sell to a global audience.

Should you offer Stripe payment plans to your customers?

Offering payment plan options to customers has many positives for both the seller and the customer. Because 'buy now, pay later' services come at a charge to merchants, some weighing up needs to be done around fees taken by the provider relative to the increase in conversion rates you could enjoy.

For larger purchases or when the value your customer will receive is spread over time (e.g., an online course), offering customers the opportunity to pay in installments increases the chance of conversion.

As this Stripe buy now, pay later guide states:

“Businesses that accept buy now, pay later services on Stripe have seen a 27% incremental uplift in sales volume. These payment methods offer customers the ability to immediately finance purchases and pay them back in fixed installments over time.”

Pros of selling payment plans to customers

Offering an installment plan to customers brings key benefits, including:

✅ Broader customer reach: By offering buy now, pay later options, you can appeal to a diverse range of customers, especially those from younger age groups, opening up opportunities to tap into new demographics.

✅ Encourages larger transactions: Providing the flexibility to pay over time can entice customers to make more substantial purchases, as they are not constrained by paying the full amount upfront.

✅ Increases conversion: Allowing customers to split payments may lead them to consider additional items or higher-priced products, ultimately increasing the overall size of their orders.

✅ Get paid upfront: When you pay via a ‘buy now, pay later’ service, you receive the full transaction amount immediately, regardless of the customer's installment status. The provider takes on the risk of customer fraud, which offers you protection.

Cons of selling payment plans to your customers

While there are many positives to offering a buy now, pay later payment plan option to your customers, there are some considerations to balance:

🤔 Fees: Buy now, pay later providers like Klarna apply transaction fees varying between 2% - 8% depending on provider and region. Klarna’s fees range from 3.29% to 5.99% plus 30¢.

Depending on which part of the world you are based in, international transactions, currency conversions, and lost delivery disputes keep the fees rising.

🤔 Customer relationships: Introducing a buy now, pay later service adds an intermediary between you and your buyers, which has the potential for increased complexity in the case of disputes or refunds.

For many, the increase in sales volume is a worthwhile trade-off for the fees and customer relationship shifts that these services imply. However, it’s always worth taking time to consider these factors in the context of your business and customer relationships.

What types of payment plans can you offer with Stripe?

Yes, there are several ways to offer customers a payment plan option with Stripe, including no-code and low-code solutions and more customized code-based integrations.

Code based payment plans with Stripe

Stripe offers several developer which enable people with coding skills to create bespoke payment set-ups for a range of payment methods, including:

- Recurring payments—which enable ongoing payments for continued access to a product

- Installment/subscription model that Checkout Page uses to deliver its phased payment plans.

No-code payment plans with Stripe

No-code payment options are user-friendly methods for anyone — regardless of coding experience — to set up secure checkout pages.

Payment plans with Stripe Checkout

Stripe Checkout is a user-friendly pre-built payment form that enables users to create and embed no-code checkout pages directly into their website or redirect customers to a secure Stripe-hosted payment page.

Stripe Checkout supports one-time payments and subscription options and can be set up with various payment methods, including credit cards, Apple Pay, Google Pay, and buy now, pay later options like Klarna and Afterpay.

Buy now, pay later payment plans with Stripe

By partnering with providers such as Klarna and Afterpay, Stripe is able to offer a range of plan options.

Each provider has different offerings and terms related to credit limits, repayment terms, and merchant location, so it is important to review these when deciding which services are the best for your needs.

Benefits of offering buy now, pay later payment plans with Stripe

Some key features of each service are:

- 👍 Klarna:

- Customers can choose from different payment methods like ‘Pay in Installments’, ‘Pay Later’, and financing.

- Pay in Installments allows customers to split costs over three or four interest-free payments.

- Pay Later in 30 days allows customers to complete a transaction and pay the full amount later at no extra cost.

- Provides financing options for customers based on their preferences.

- 👍 Afterpay:

- Afterpay, known as Clearpay in the UK, allows customers to split their payments into interest-free installments.

- Offers ‘Pay in 4’ for smaller purchases and finance options for higher-value orders with monthly interest-bearing installments in the US.

- Initial spending limits are set for new customers, which increase over time and reward responsible spending habits.

When you probably shouldn't use 'buy now, pay later' services

In addition to the benefits buy now, pay later options provide to both sellers and buyers, it's important to note that these services may not align well with your business if:

⚠️ Your clientele consists primarily of businesses, as buy now, pay later methods on Stripe are designed for consumer use only.

⚠️Your business heavily depends on subscription-based or recurring transactions, as current buy now, pay later options do not accommodate invoicing or subscription services.

In addition to the B2B and subscription restrictions, each provider prohibits certain business categories as follows:

- Klarna

⛔ Prohibited business categories include:- Charities

- Political organizations, parties, or initiatives

- Afterpay:

⛔ Restricted business categories include:- Alcohol

- Donations

- Pre-orders

- NFTs

Whatever your unique business and customer base, take the time to review Stripe’s buy now, pay later partner offerings to ensure they are a good fit.

How Checkout Page helps you offer Stripe payment plans

As a trusted Stripe partner, Checkout Page allows sellers to offer their customers a payment or installment plan—and we do things a little differently!

Our payment plan uses Stripe’s subscription service to put our customers in the driving seat when it comes to creating a plan that fits their product and customer base best.

Unlike buy now, pay later plans, with Checkout Page, there are:

✅ No 3rd party intermediaries between you and your customers

✅ No additional fees to the seller for using the feature

Additionally, the following key features of the plan are placed fully in the seller's control:

✅ Amount per payment

✅ Frequency of the installments

✅ Duration of installments

The payment plan feature can be used in conjunction with features such as an initial setup fee or deposit and an adjustable free trial period, making it much more flexible and customizable than a buy now, pay later plan from a third-party provider.

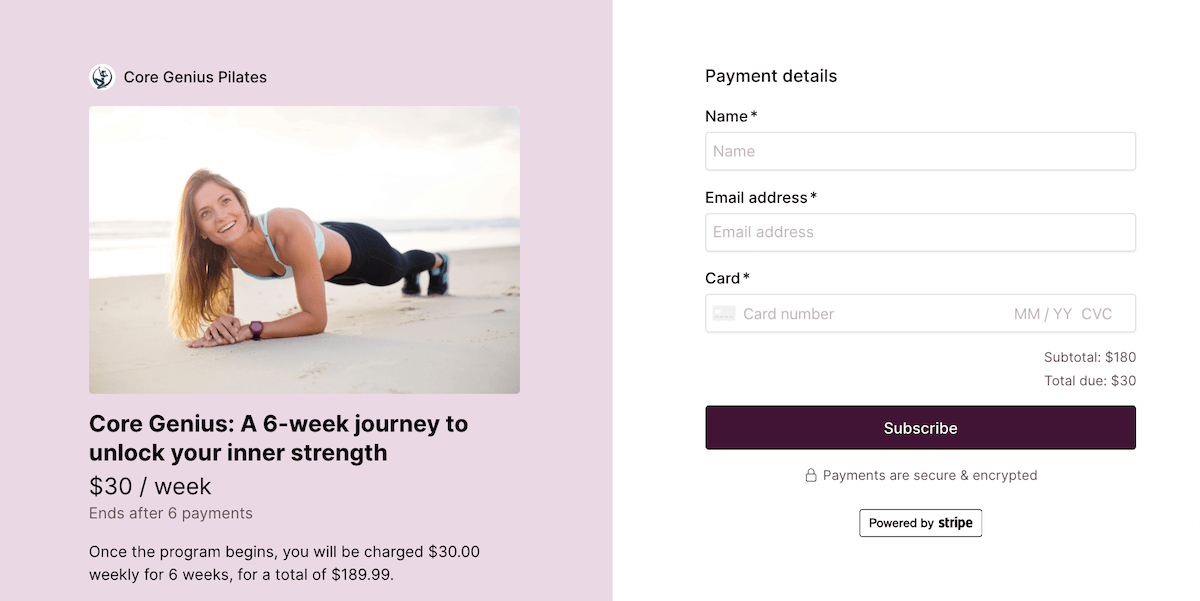

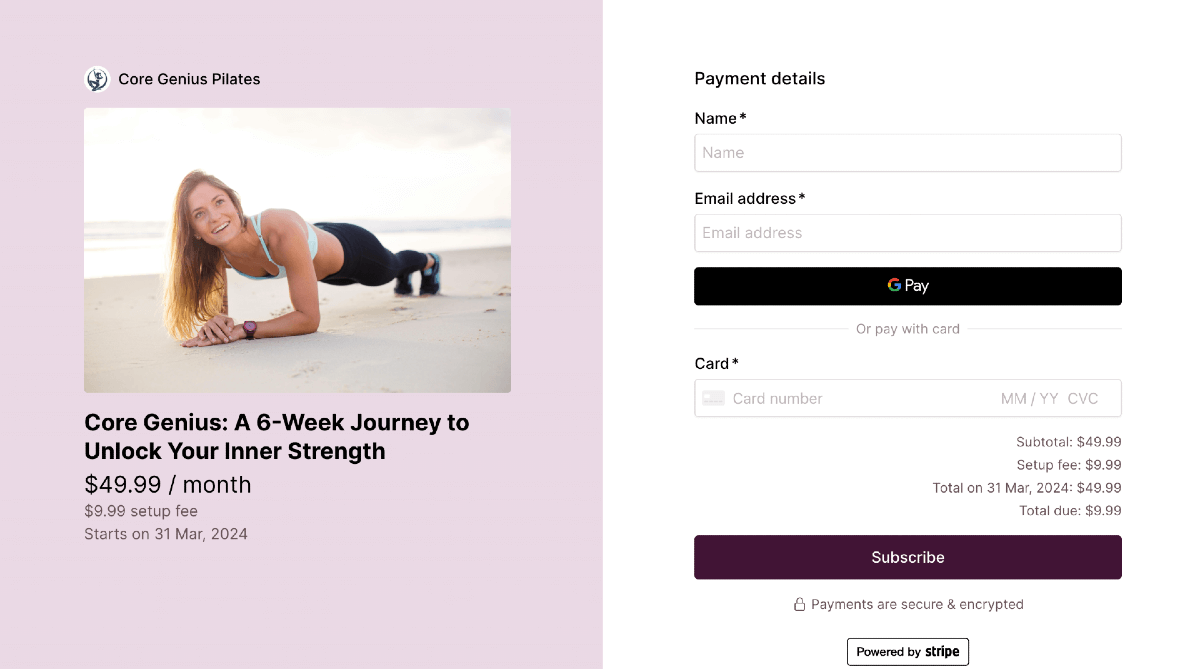

Example: Six month payment plan template

Checkout Page customer example

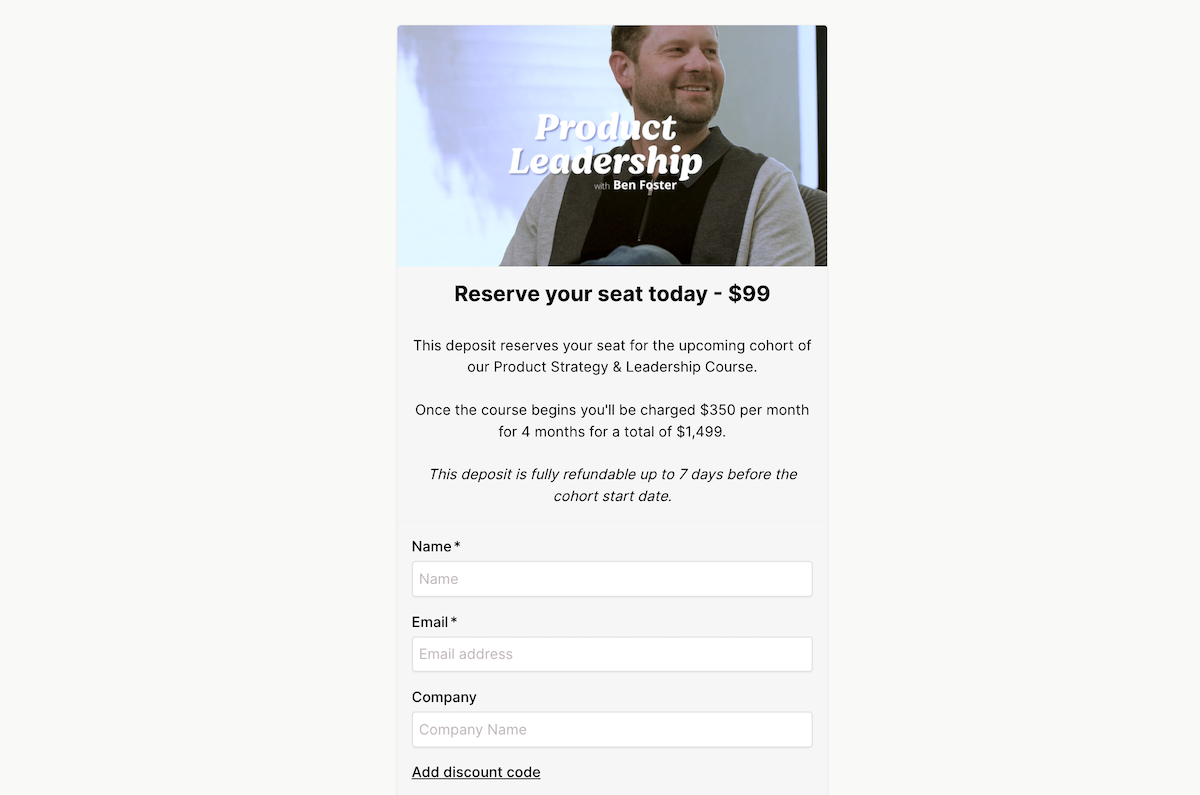

Checkout Page customer Gigantic uses the payment plan option in conjunction with other features to offer phased payment to an audience interested in their live multi-week training programs:

Gigantic’s Product Leadership course costs a total of $1,499 and is set up as follows:

- Initial $99 refundable deposit (Setup fee)

- Payment plan with 4 monthly payments of $350 ($1400)

- Start date (charge of first payment plan cycle) set to start of cohort (25 March 2024)

As Gigantic demonstrates, not only can you make a high-value product much more accessible to a wider audience, but you don’t have to pay the fees that are applied with buy now, pay later!

Customers can cancel these payment plans midway, meaning they are not guaranteed to receive the full payment. However, the risk of customers not paying all their installments is low in the contexts for which these payment plans are suitable.

For example, if the installments all need to be paid ahead of an event, attendance will only be possible for those who have paid in full. For online courses where the payment spans throughout the course, customers will typically have made enough of an upfront financial and time commitment to want to miss out on completion by ending their payment early.

Some tips to bear in mind to mitigate the risk of loss when selling a product in installments are:

- Take an upfront payment or deposit: Be clear about whether and when it is refundable.

- Offer incentives for completing the plan: Motivate customers to stay engaged with the full subscription by offering discounts or bonuses for completing the entire program. This could be a completion certificate, access to bonus content, or a discount on future services.

- Focus on customer retention: Providing excellent value throughout the duration is key to keeping people on board

How to set up payment plans with Stripe & Checkout Page

Let’s take a look at how to use Checkout Page to set up a course on an installment plan basis, which takes advantage of some of the other features that Checkout Page offers.

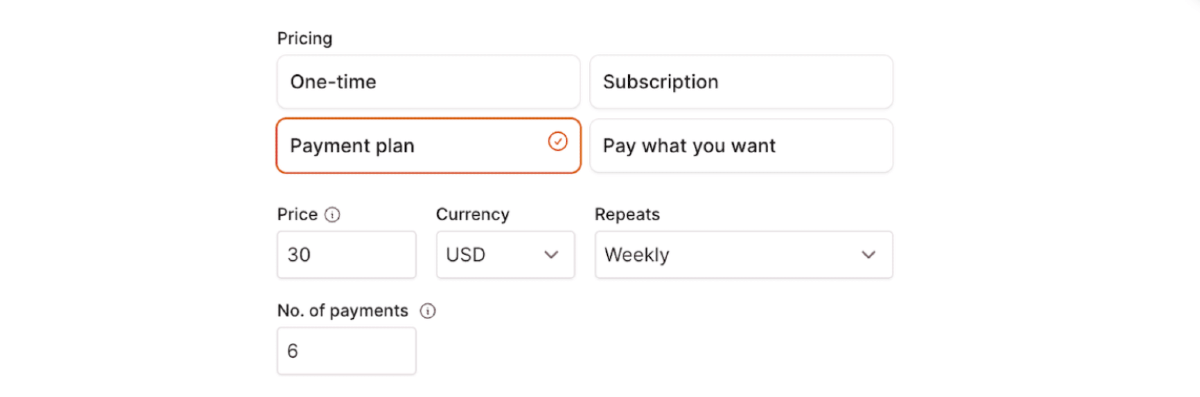

Step 1: Create a Checkout Page

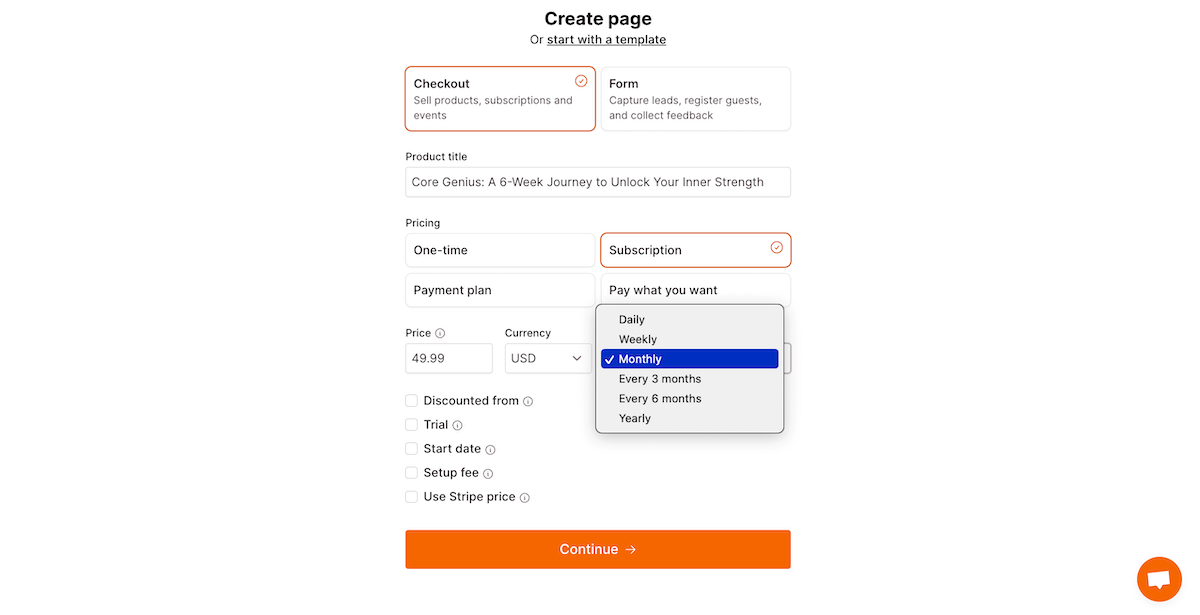

The process starts with a very simple page creation form, which enables you to name your product and select from a number of pricing options, including ‘Payment plan’:

Step 2: Customize your payment setup

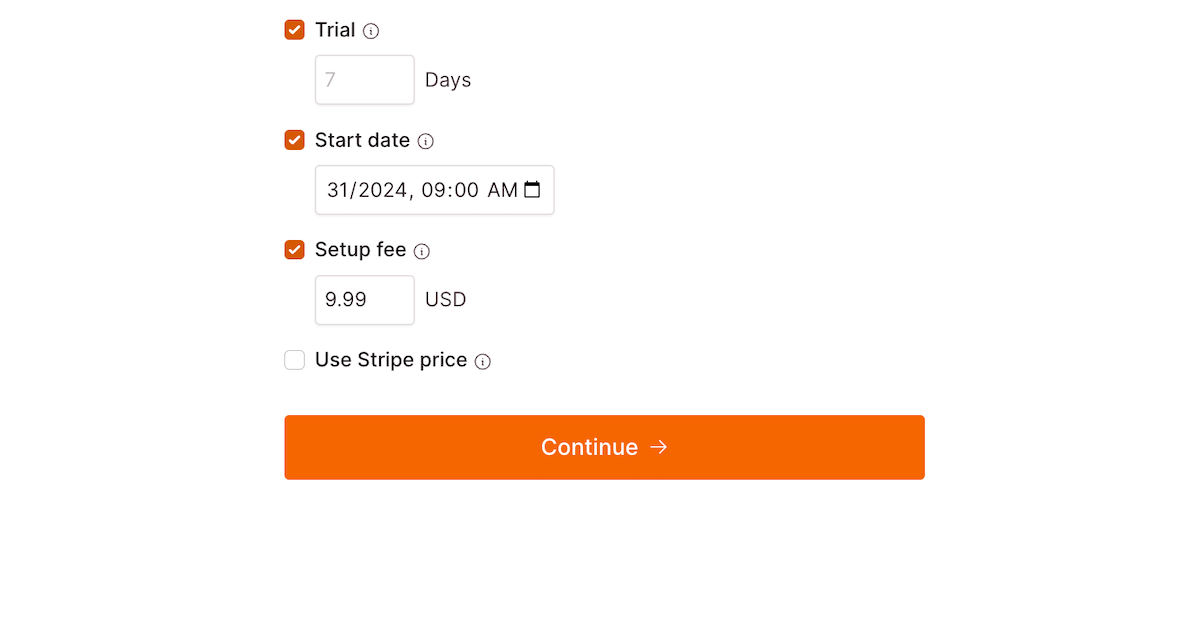

On this same initial form, you get to offer your customers a trial period before they pay, a payment start date and an initial setup fee, as we saw in our Checkout Page customer example above:

Step 3: Choose how you will use your Checkout Page

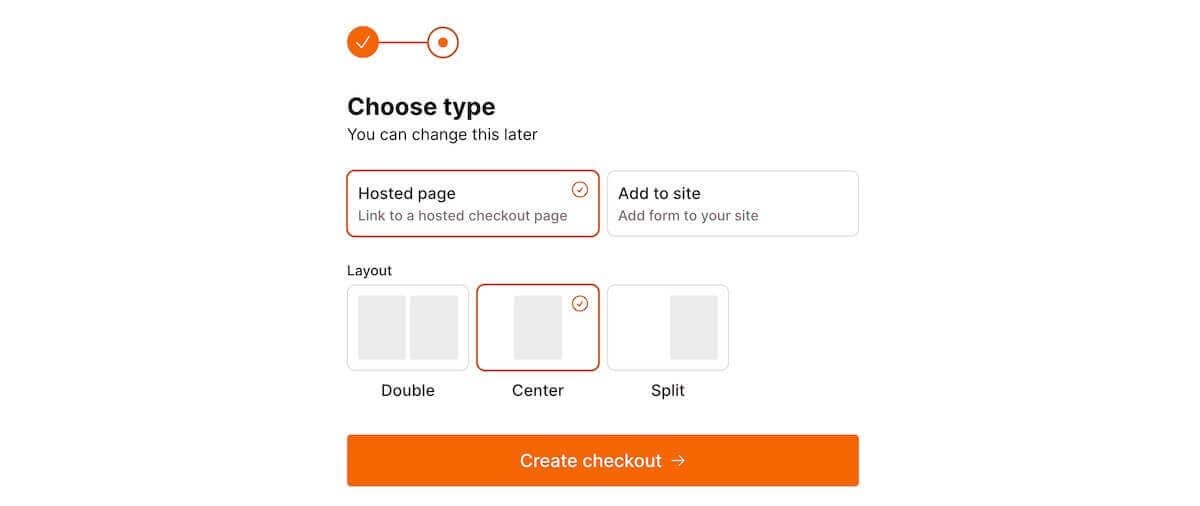

This form enables you to choose how you will use your checkout page; either as a hosted page accessible via a URL, or as embed code to be placed on a website. You also get simple layout options for your page:

Step 4: Add your product description

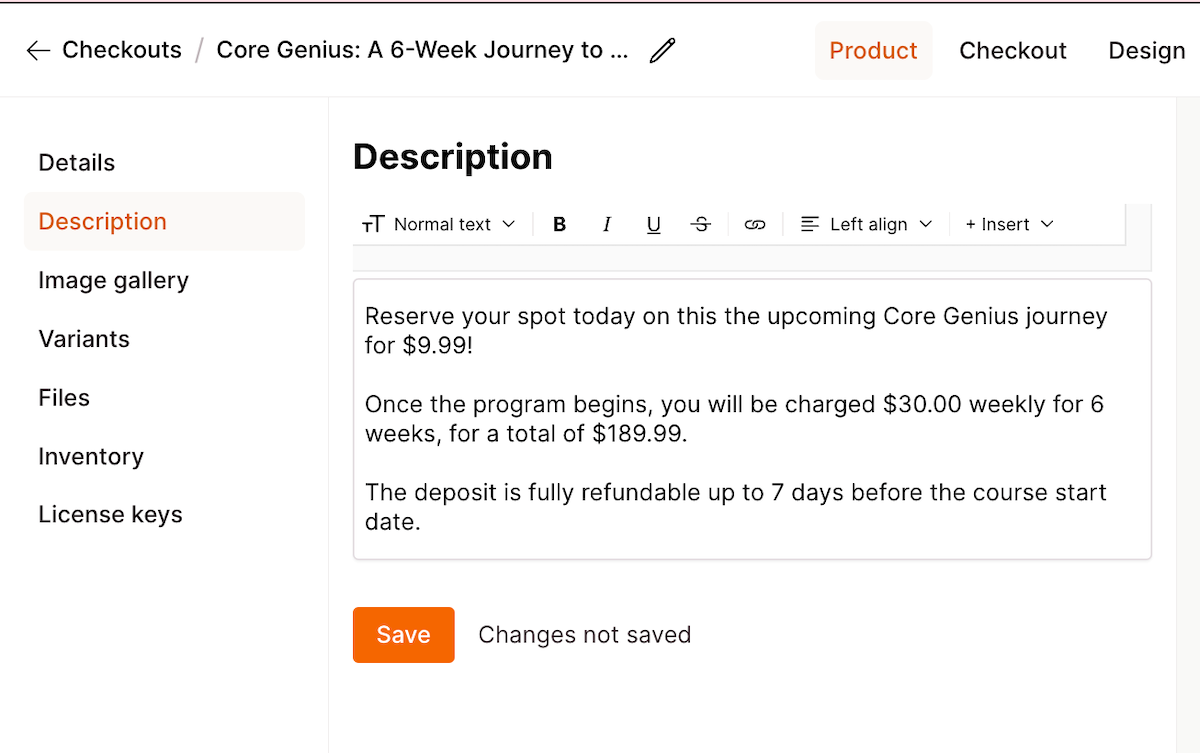

Adding a punchy, concise description to let customers know exactly what they are purchasing is made quick and simple with your product setup form:

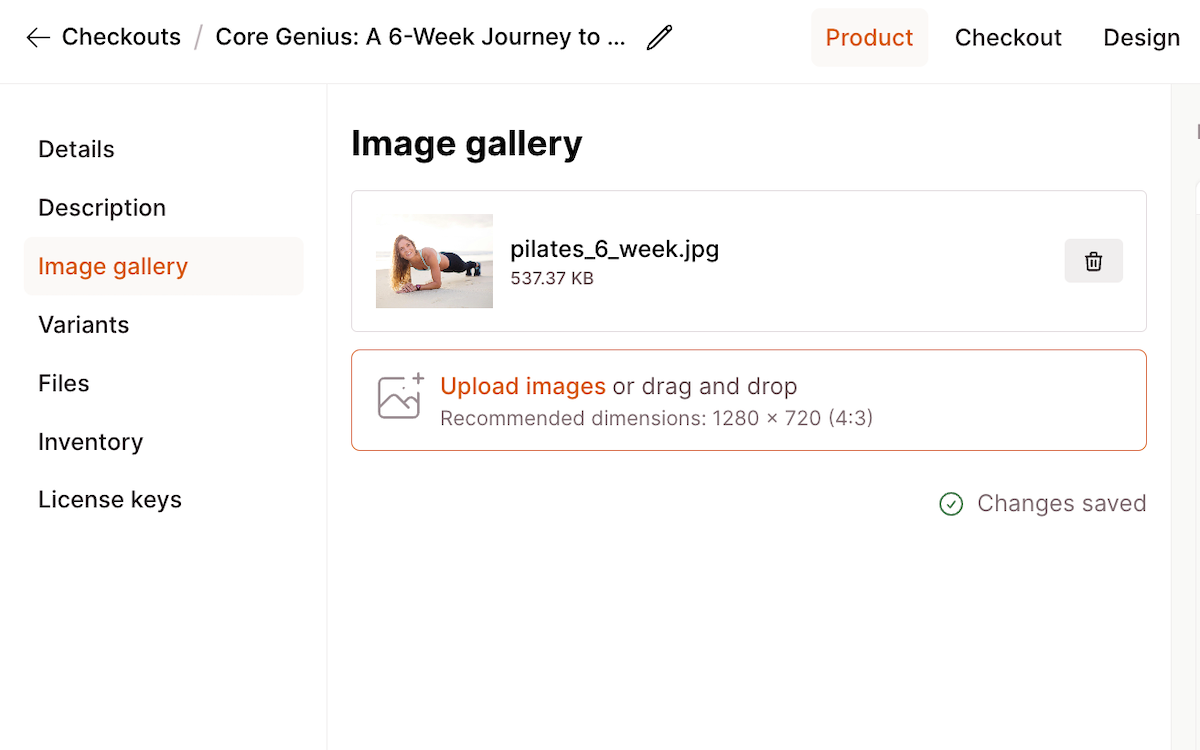

Step 5: Add images to your Checkout Page

The Image Gallery allows you to add images and make your product page stand out in a couple of clicks!

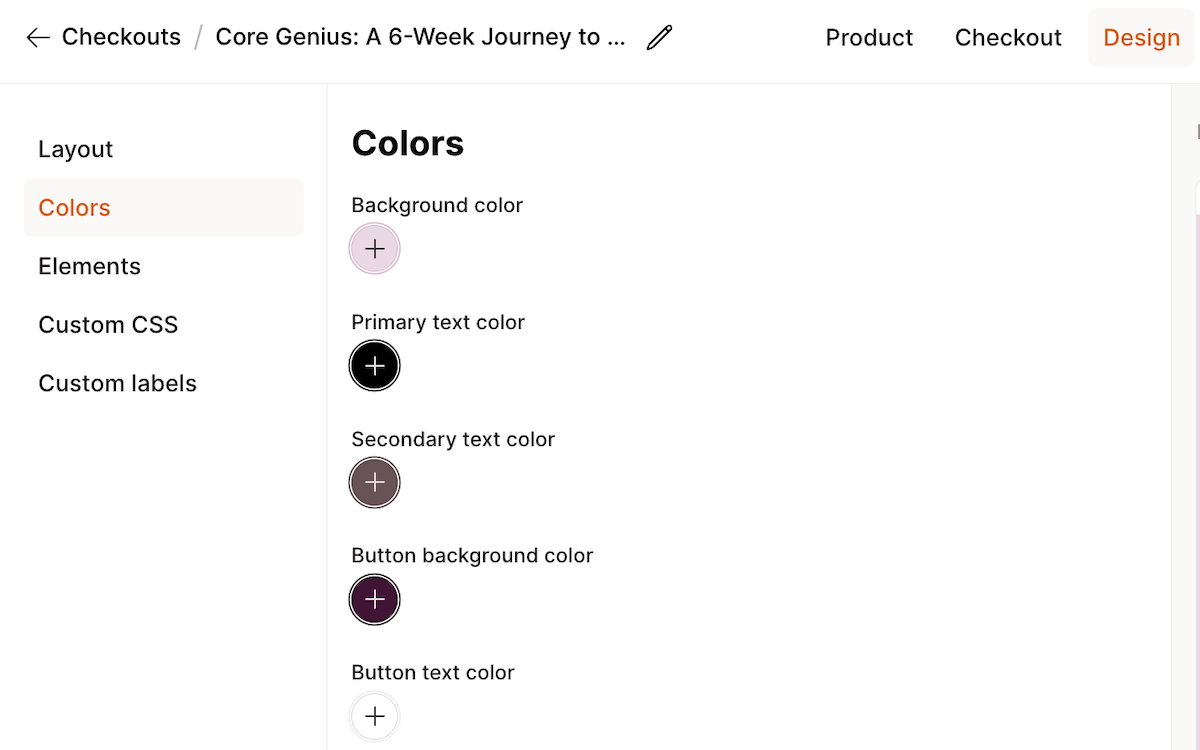

Step 6: Customize your page to match your branding

Checkout Page gives you simple options to adjust the key features of your page, such as background, button, and text colors, so you can match your branding.

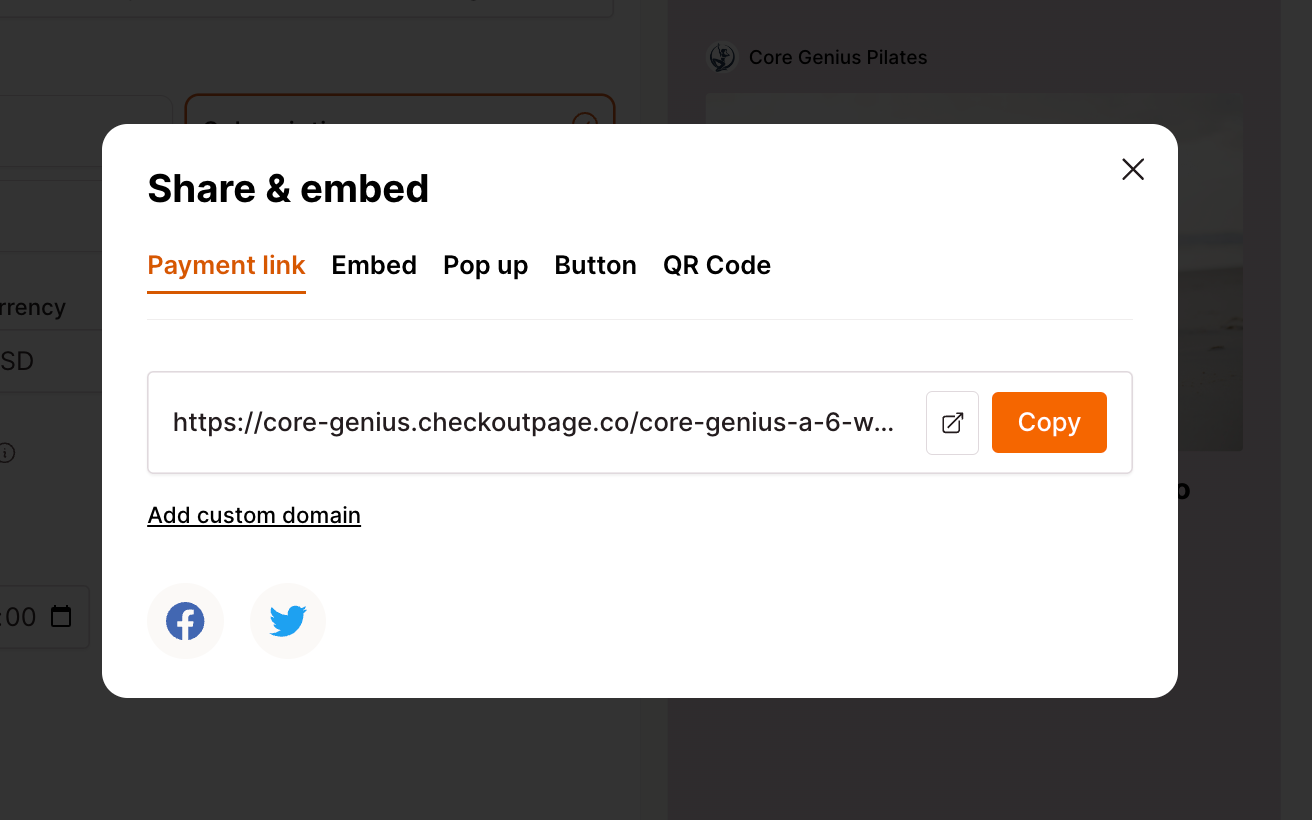

Step 7: Share and embed your Checkout Page

Once you are ready to share your page, you can select from link, embed code, and QR code options to make your product more discoverable by potential customers.

Step 8: Preview your Checkout Page design

At each step, you preview your page as it would look to a customer and make changes and adjustments in a few clicks until it’s ready to share.

Conclusion

In this article, we’ve examined different types of payment plans, what Stripe offers in this arena, and why offering payment plans to customers can make your product more accessible to a wider audience and reduce the barriers to purchase compared to full upfront payment.

In addition to the positives, we’ve considered some cautions and restrictions to consider when deciding whether payment plans are suitable for you and your customers.

We looked at a Checkout Page customer’s setup that’s working brilliantly, showcasing the payment plan option in conjunction with other features.

Lastly, we have looked at how quick and simple it is for you to set up your no-code product page using the payment plan option and have it ready to share with an audience in minutes!

Considering selling digital products with Stripe? Why not take a look at our article How to sell digital products with Stripe and Checkout Page.

If you are looking for inspiration on turning your ideas into a reality this year, take a look at Best digital products to sell in 2025.