Multiple payment methods

Optimize checkout with multiple payment methods tailored to European markets. Seamlessly integrate Ideal, Bancontact, Klarna, Afterpay, and the rising trend of Buy Now Pay Later options into your payment form.

In the modern ecommerce landscape, providing a single, one-size-fits-all method of payment is no longer sufficient. Savvy businesses are now expanding their payment options to cater to a broader range of customers and their diverse needs. Our focus here is on multiple payment methods, specifically Ideal, Bancontact, payments in Europe, Klarna, Afterpay, and the increasingly popular Buy Now Pay Later (BNPL) schemes. Offering these options within your checkout form can significantly enhance your customers' purchasing experience.

Firstly, let's understand why including various payment methods is beneficial.

-

Increased Conversion Rates: One of the primary advantages of offering multiple payment methods is the potential for improved conversion rates. When customers have the flexibility to choose their preferred payment method, they are more likely to complete their purchases. This is particularly true for international customers who may prefer local payment options like Ideal and Bancontact.

-

Better Customer Experience: Different customers have different preferences when it comes to making payments. Some might prefer traditional methods like credit or debit cards, while others may lean towards more modern methods like Klarna or Afterpay. By offering a variety of options, you cater to everyone's preferences and positively impact the overall customer experience.

-

Boosting Trust and Credibility: Familiarity builds trust. The presence of well-known payment methods like Ideal and Bancontact at the checkout instills confidence in customers about your checkout form's security, enhancing your business's credibility.

-

Buy Now Pay Later (BNPL): The proliferation of BNPL options such as Klarna and Afterpay has dramatically changed the ecommerce landscape. These options facilitate the spread of payment over time without requiring the customer to pay any interest if they repay within the agreed period. Incorporating BNPL options into your checkout form can help attract financially-conscious customers who prefer to spread out their payments.

There are several factors to consider when deciding which payment methods to offer. These include the target audience's preferences, transaction fees, compatibility with existing systems, and regulatory requirements, to name a few. It's also crucial to keep track of emerging trends, like the growing popularity of BNPL schemes, to ensure your checkout form remains up-to-date.

Implementing multiple payment methods in your checkout form is a strategic move that can enhance customer satisfaction, boost conversion rates, and increase revenue in the long run. Regardless of the type of business you operate, it is a strategy worth considering if you wish to remain competitive in the ever-evolving ecommerce space.

How Checkout Page works

- Step 1: Create checkout pages for your products and services

- Step 2: Embed these checkout pages on your website using a few lines of code or share a hosted page, or display a QR code

- Step 3: Start making sales and collect data, with payments processed through Stripe

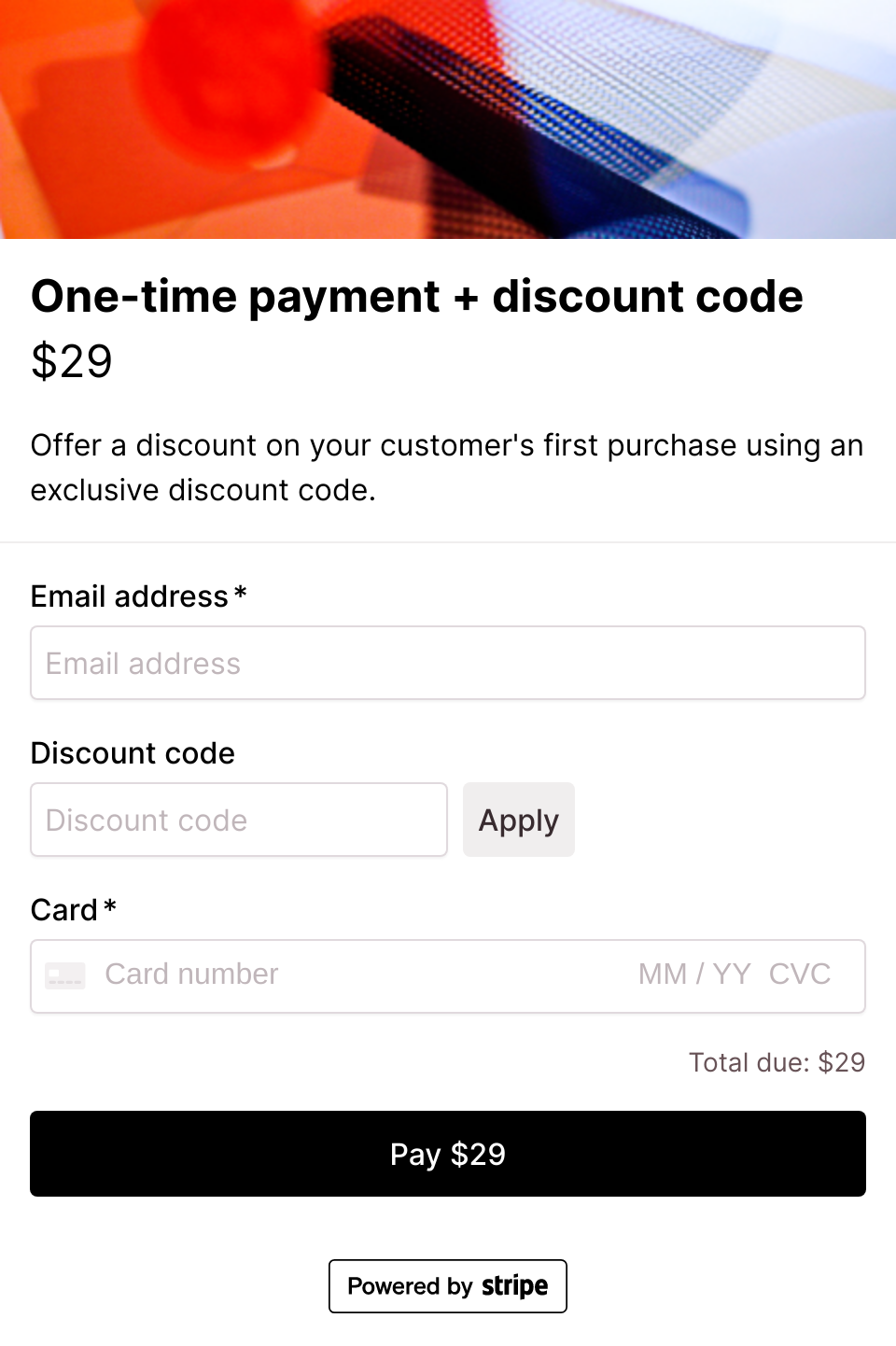

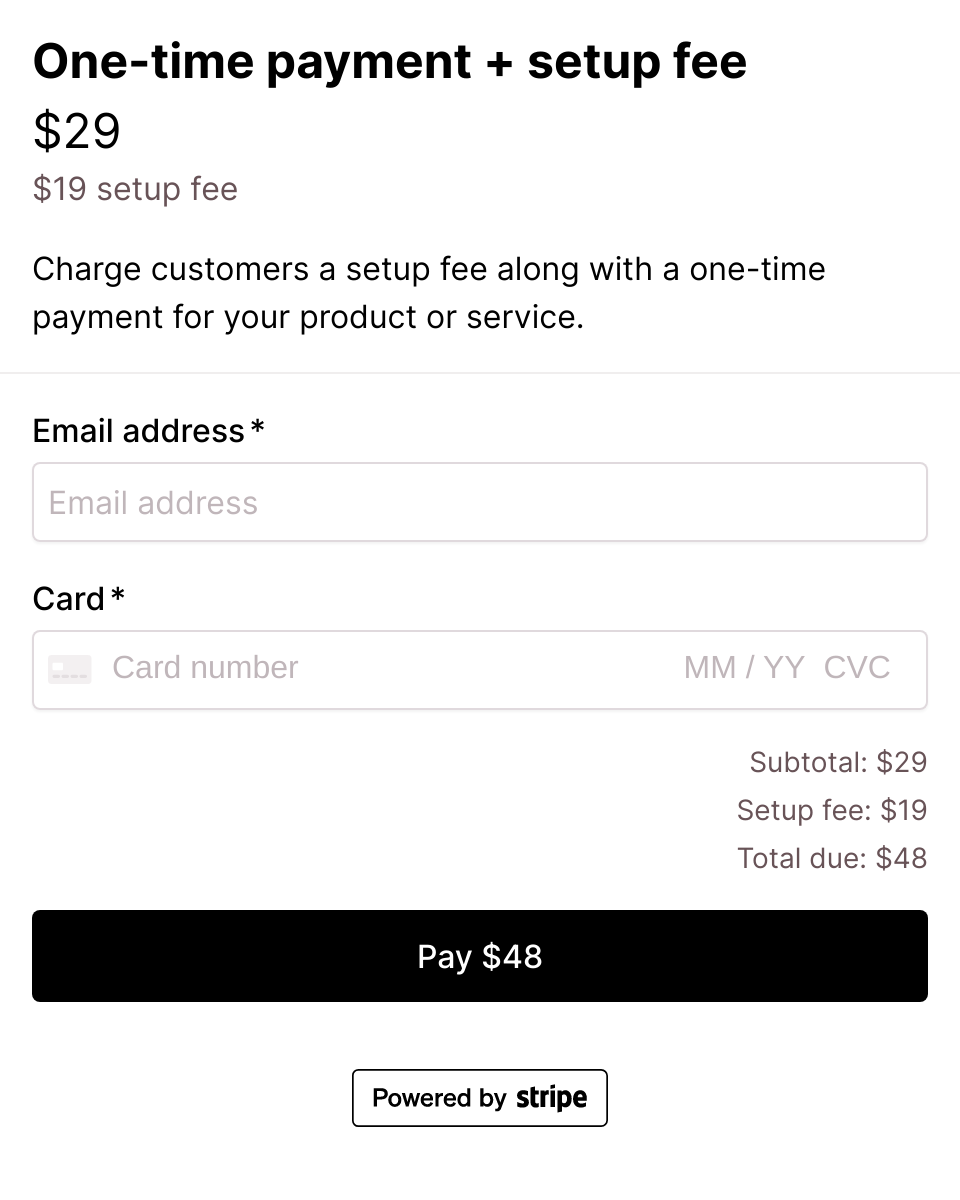

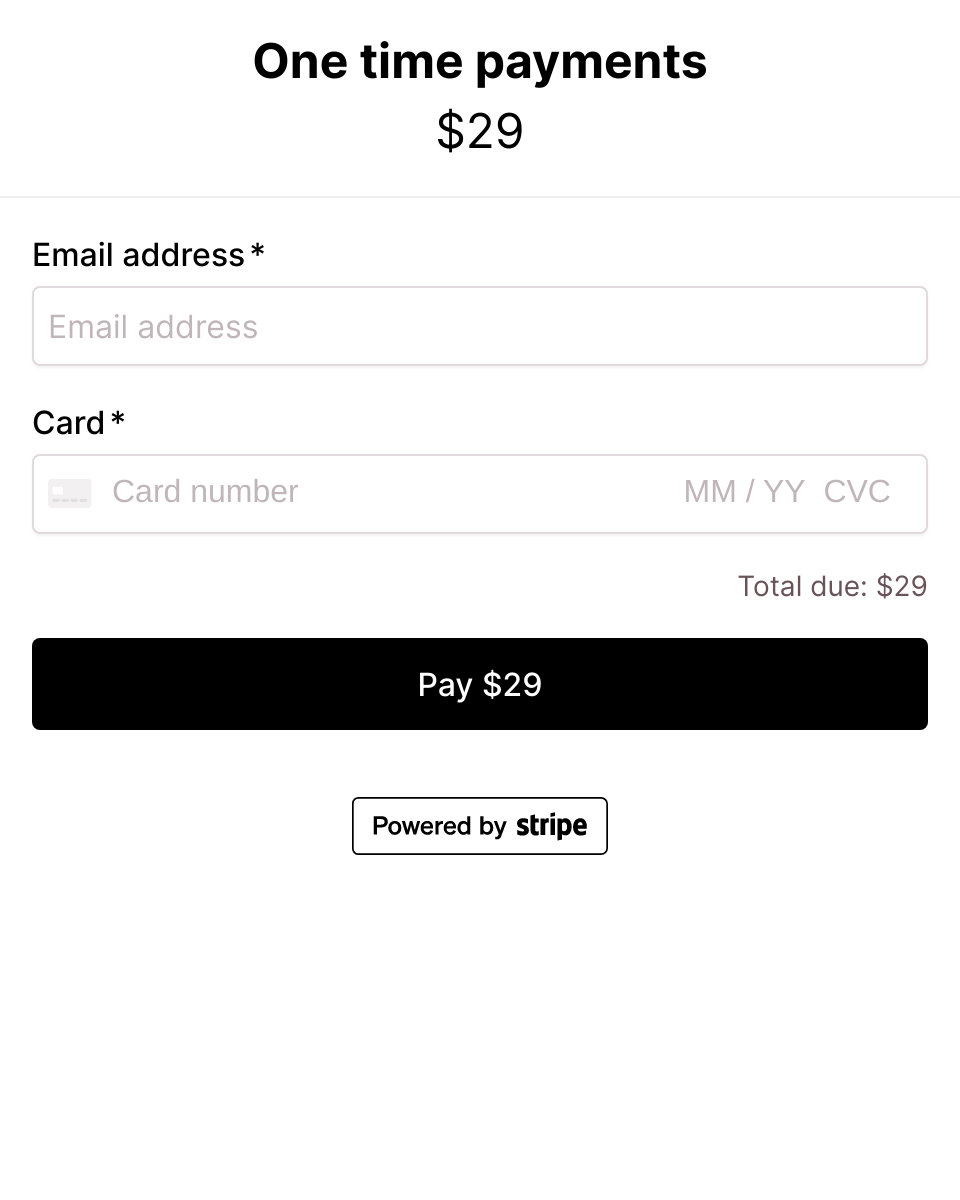

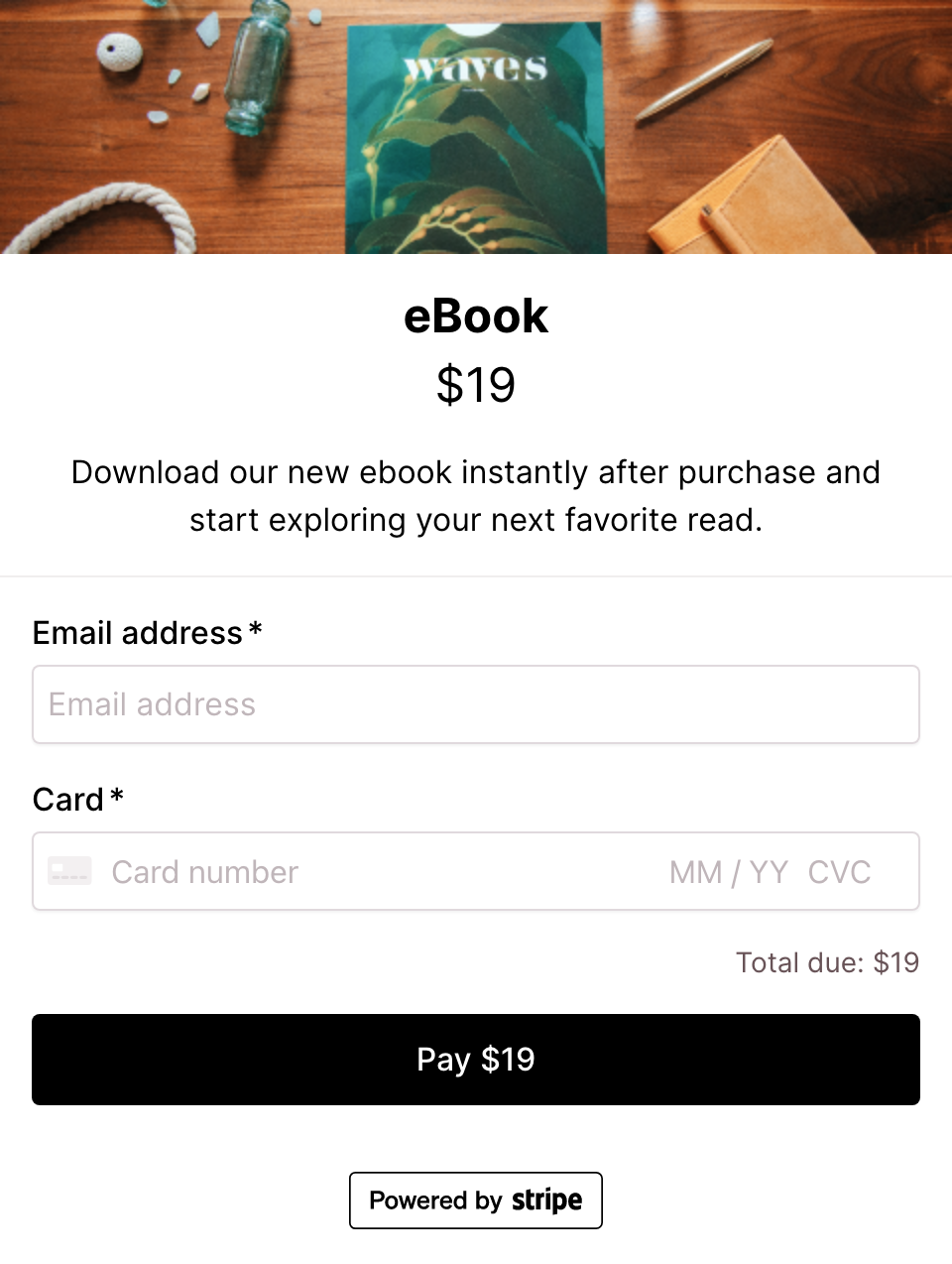

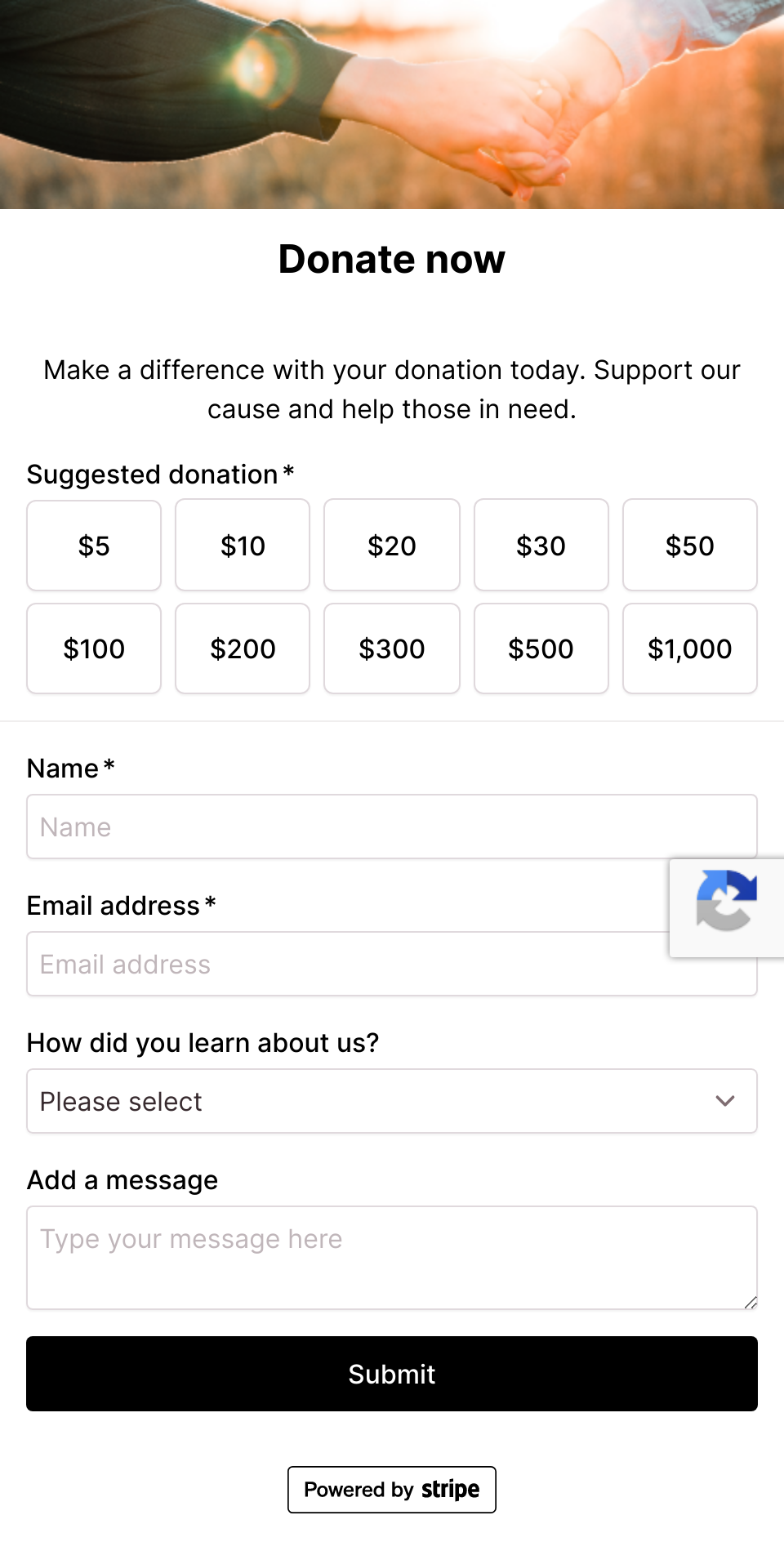

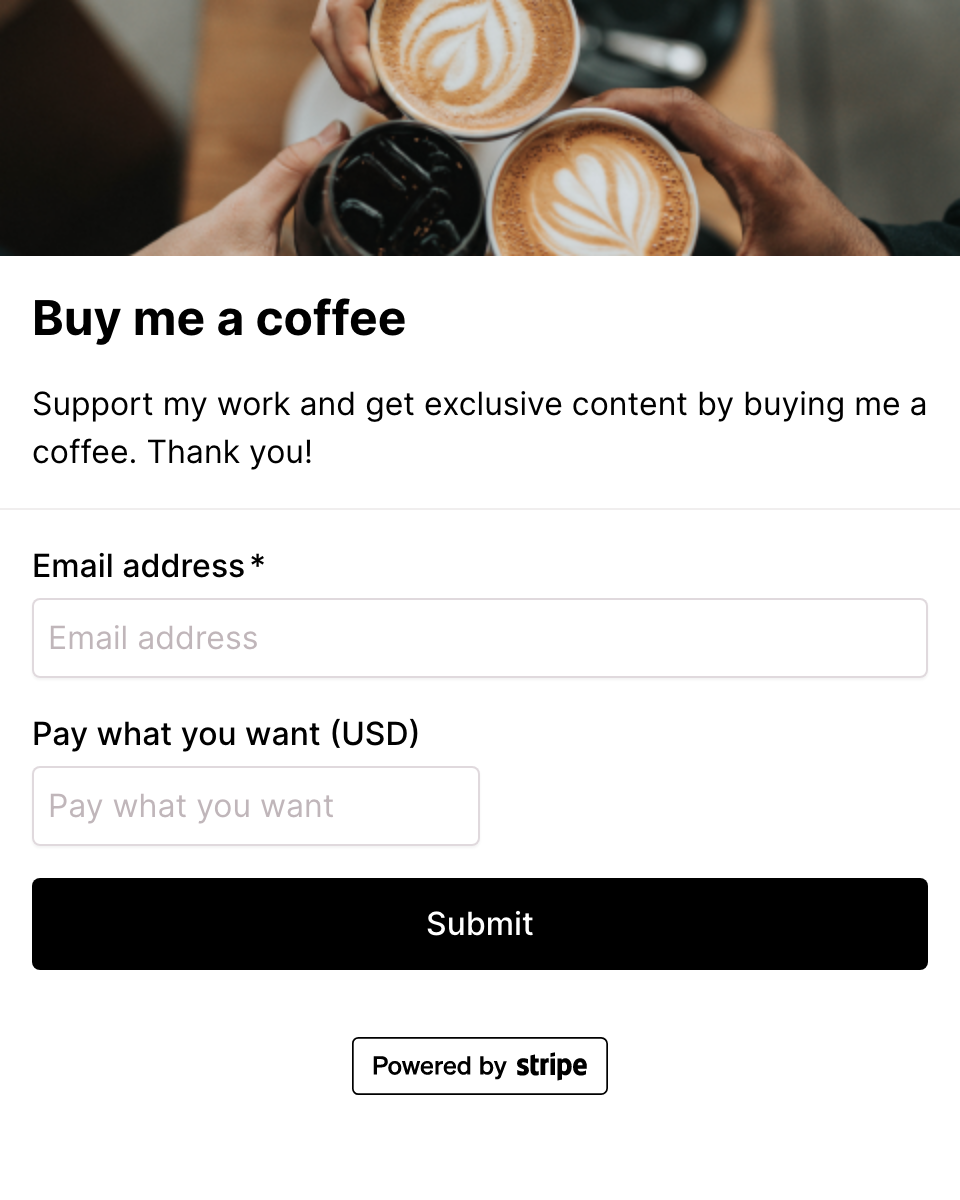

Related templates

View all related templatesLatest templates

View all templatesStart selling in minutes with our no-code checkout page builder.

Create branded, custom checkout pages and increase revenue with one-click upsells and order bumps.

Whether on your website or in your sales funnel, our simple checkout process boosts sales.

Get started

Features

Use cases

2025 © Checkout Page. All rights reserved.